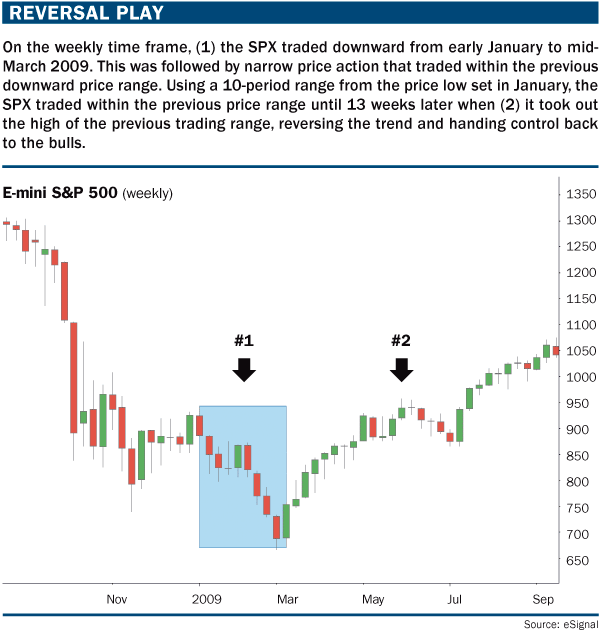

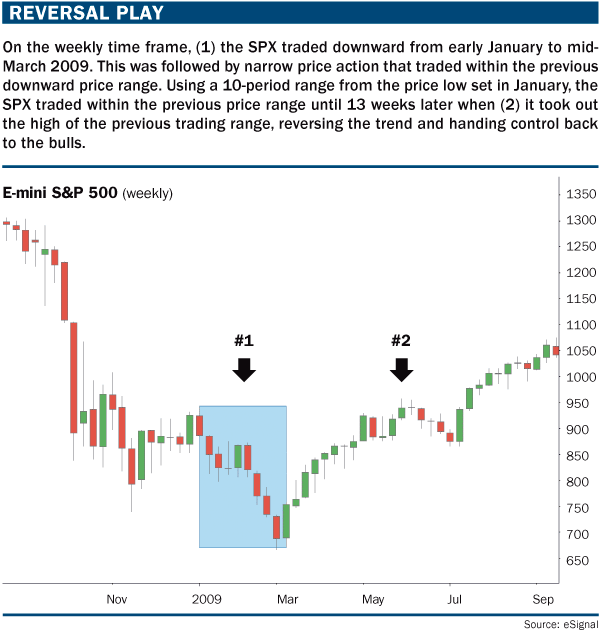

This means that once you notice it on the chart you can expect the price will change its direction. A take a look at was performed utilizing the sushi roll reversal technique versus a standard buy-and-hold technique in executing trades on the Nasdaq Composite throughout a 14-year interval.

Market Reversals And The Sushi Roll Strategy Marketing Reverse Investing

Data from many time periods are combined into a single price bar in candlestick charts.

. This pattern involves a study of 10 candles to deeply understand the shift in the market sentiment. This pattern has several bars instead of just two bars. How was it named.

This pattern involves a study of 10 candles to deeply understand the shift in the market sentiment. To identify a sushi roll the candlesticks are divided into two halves. The design is unrelated to the Japanese cuisine Sushi Roll Traders gave this name because they had discussed this concept during lunch.

While Fisher discusses five-bar patterns the number or duration of bars is not set in stone. Sushi Roll Sushi Roll is a candlestick pattern consisting of 10 bars where the first five inside bars are confined within a narrow range of highs and lows and the second five outside bars. It reveals the general market sentiment.

3 the pattern is similar to a bearish or bullish engulfing. The Sushi Roll Reversal Pattern is a technical tool analysis for candlestick chart interpretation. The design is unrelated to the Japanese cuisine Sushi Roll Traders gave this name because they had discussed this concept during lunch.

How does the Sushi Roll look like. As mentioned above the appearance of a sushi roll reversal pattern during a downtrend serves as a warning of a possible trend reversal. How was it named.

The first five candles show a sideways movement without any major oscillations and the remaining five candles engulf the highs and lows of these first five candles. Sushi roll reversal technique returns have been 2931. Trend reversals signal change in trend thereby providing opportunities to enter or exit a trend depending on the location of the reversal.

A trend reversal is indicated by the appearance of the sushi-roll pattern during a dominant trend. When a bullish or bearish Engulfing candle is identified we also look at the Overbought and Oversold. The Sushi Roll Reversal Pattern is a technical tool analysis for candlestick chart interpretation.

First lets define reversal. This indicator will give you a buy and sell signal based on the Engulfing pattern combining with the RSI Relative Strength Index indicator. The sushi roll that was defined by Mark Fisher trader and author of the book The Logical Trader.

The Sushi Roll technique was developed by Mark Fisher in his book The Logical Trader The Sushi. I cannot promise you will encounter the Sushi Roll often but it is possible to identify it in any chart timeframe. The Sushi Roll pattern is used to identify major reversals in the stock markets.

First of all a trend reversal is a period in the chart when a trend changes direction. Sushi roll reversal pattern fisher defines the sushi roll reversal pattern as a period of 10 bars in which the first five inside bars are confined within a narrow range of highs and lows and the second five outside bars engulf the first five with both a higher high and lower low. On the other hand when the sushi roll pattern appears during an uptrend it sends a signal to traders to sell their.

This will help us understand what a reversal is. He basically compares 5 bars inside bars to the next 5 bars outside bars he says the time frame isnâ t important as long as your are consistent with comparing the latest 5 increments of time with the prior 5 increments of time. The Sushi Roll Pattern is a candlestick pattern that signals trend reversals.

When the sushi roll pattern shows up in a downtrend it warns of a possible trend reversal showing that its a good time to look to buy or at the very least exit a short position. This is a method that allows you to have an extra piece of. The first five candles show a sideways movement without any major oscillations and the remaining five candles engulf the highs and lows of these first five candles.

One of these patterns are the sushi roll pattern. The Sushi Roll pattern is used to identify major reversals in the stock markets. The Sushi Roll is a reversal pattern which means you can expect the price to change its direction after the appearance of the pattern.

Later on October 11 2011 and December 1 2011 bullish signals were signaled as sushi roll patterns formed as Google began to climb higher in price from each entry point. Bearish Sushi Roll Pattern Source. Trend reversal signals - sushi roll reversal patterns - Zero To Hero 79 D K Sinha this video on technical analysis tutorial for beginners educates on tr.

This pattern is very similar to the bearish and bullish-engulfing patterns. Bitcoin technicalanalysis bitcoinchartIn this video I want to show you guys a possible technical analysis reversal pattern for bitcoin after a huge corre. In Mark Fisherâ s book he defines a Sushi Roll as an early indicator or a possible trend reversal.

If it occurs during an uptrend the trader gets ready to sell. If youre trying to get your sushi roll right you should have a sushi roll reversal pattern. Sushi Roll Pattern.

It demonstrates a potential opportunity for traders to buy stocks or other assets or to exit a short position. Sushi in trading The Sushi Roll belongs to reversal patterns. A reversal pattern is one in which the trend direction of stock reverses from the prevailing one.

Data from many time periods are combined into a single price bar in candlestick charts. The Engulfing candlestick is considered to be a reliable pattern for reversal trading. Jul 9 2019.

Sushi Roll Reversal Pattern The sushi roll pattern comprises the most recent ten candlesticks on a technical chart and can be indicative of a market reversal. The method was developed by Mark Fisher and it gives you a warning about a possible reversal pretty soon.

Can Anyone Explain This Pattern To Me Forex Factory

Market Reversals And How To Spot Them Smart Trader

How 10 Candles In A Chart Pattern Make A Sushi Roll Business Standard News

Targeting Entries With Inside Price Bars

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Reversals_and_How_to_Spot_Them_Feb_2020-01-e095170ce0124494b2fac8e4a17eb023.jpg)

Market Reversals And How To Spot Them

Technical Analysis Inside Bar Patterns And The Sushi Roll Traders Com Advantage

Technical Analysis Inside Bar Patterns And The Sushi Roll Traders Com Advantage

0 comments

Post a Comment